What are pooled funds?

Why do investors pool funds instead of investing themselves?

YOU may have heard about exchange traded funds (ETFs), mutual funds, or unit investment trust funds (UITFs) from friends, fellow investors, salespersons, etc. More likely, you are aware that they are all categorized as pooled funds.

As the term “pooled funds” implies, money invested by different individual investors are combined for the purposes of investment.

Why do investors pool funds instead of investing themselves? Let us run through some of the possible reasons…

Diversification. Since a pooled fund holds a lot of investment instruments, it reduces risk compared to holding a single investment instrument.

Liquidity. Shares can be redeemed at any time based on the closing net asset value per share (NAVPS) of open-ended funds.

Professional investment management team. You would have access to group of analysts typically only available to high net worth investors. These professionally managed team will take care of managing the pooled money, researching and trading individual investment instruments.

Can participate on investments not available to individual investors. In the Philippines, the primary bond market can only be participated by accredited groups. Since individual investors generally participate on the secondary market, this is a big advantage of accredited fund houses over individual investors.

Convenience. Since pooled funds are professionally managed, investors can immediately participate on the financial industry without having to learn all the intricacies of each individual investment instruments, thereby saving time and effort.

Government regulated. There is high degree of governance oversight. Bangko Sentral ng Pilipinas (BSP) for UITFs and Securities Exchange Commission (SEC) for ETFs and mutual funds.

Though investing in pooled funds has lots of advantages, it is important to consider some of the possible disadvantages, such as:

Fees. Since a professional management team is involved, there are some fees involved such as entry fees, exit fees, annual fees, etc. Depending on the investment instrument, some of the fees are waived or adjusted incrementally based on the investment amount and time horizon.

Difficult to time. Since pooled fund aggregates all the assets, it will be difficult to time the buying and selling of shares, relative to individual stock.

Cannot customize. Since pooled fund is managed by professional management team, they control what investment assets to buy, hold and sell.

ETFs, mutual funds, and UITFs have a lot of similarities. The major difference between ETFs against mutual funds and UITFs is that, it is a closed-end fund. Whereas mutual funds and UITFs are generally open-ended fund.

Closed-end funds have a fix number of shares. Buyers can purchase shares from existing shareholders.

Open-ended funds can issue additional shares and redeem shares any time. Buyers will purchase shares from the fund itself instead of existing shareholders.

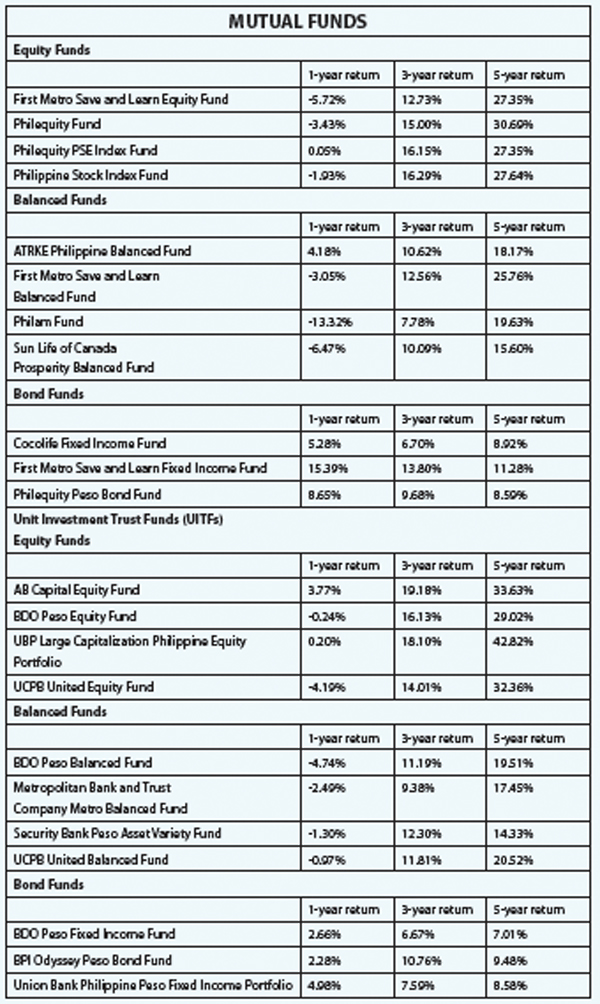

Since there are a number of pooled funds, you can consider the short-listed ones first.

Exchange Traded Funds (ETFs)

In the Philippines, we only have one ETF, First Metro Philippine Equity and this was launched on December 2, 2013.

Where can we purchase these pooled funds?

ETF-Stock exchange. You need to have a stock brokerage account.

Mutual Fund-Fund companies. Licensed salesperson, a.k.a. Certified Investment Solicitors (CIS).

UITF-Banks

Feel free to share your questions or thoughts by sending me an e-mail. Have fun investing!

****

Christopher Lim is a Registered Financial Planner of RFP Philippines. He is a co-founder of www.pinoyFIQ.com and an investor on Financial and Real Estate industries. He is also a Coach and Resource Speaker on Financial Management, Investments (such as Bonds, Mutual Funds, Stocks, and Derivatives), Estate Planning, and Real Estate.

Christopher Lim is a Registered Financial Planner of RFP Philippines. He is a co-founder of www.pinoyFIQ.com and an investor on Financial and Real Estate industries. He is also a Coach and Resource Speaker on Financial Management, Investments (such as Bonds, Mutual Funds, Stocks, and Derivatives), Estate Planning, and Real Estate.

Source: http://www.businessmirror.com.ph/index.php/en/business/banking-finance/28370-what-are-pooled-funds

Comments

4,979 total views, 2 views today

Social