Ways To Budget

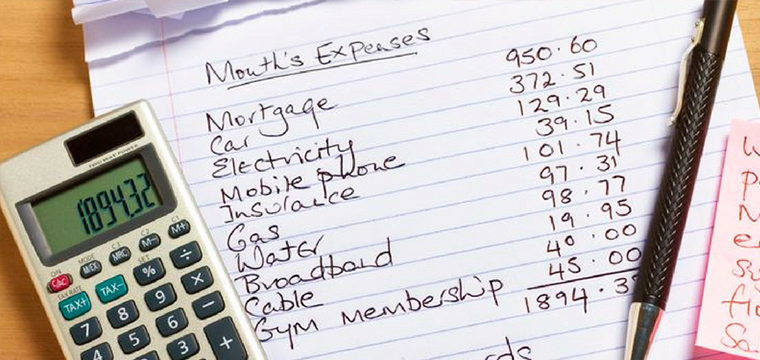

PLANNING helps us progress from the present to the desired future. In the context of personal finance, one of the recommended imperatives in planning for a sustainable financial life is the development of a personal budget. This is a tool that facilitates the allocation of finite financial resources to personal priorities.

Budgeting will entail awareness of the current financial condition, foresight in terms of desired financial goals and commitment with respect to implementing plans. Over the course of time, there have been quite a number of budgeting techniques that have been proposed, and let us discuss some of these.

One crude way to budget is to simply base expenses and savings on what the actual bank account balances are at a given point in time. The total bank account balance serves as the limit. Tracking of expenses and savings will not be that rigorous.

This method can work for people who are simply too busy or who really do not have any interest in the details of budgeting. This method can have negative repercussions, though, if a person has a propensity to overspend and does not really put enough focus and effort on saving.

One popular way to budget is “envelope budgeting.” Expenses and savings are identified and reviewed either through accumulated receipts or sheer memory. These are divided into different categories and each specific category is then assigned a specific envelope. From the total income that is generated, cash is withdrawn and is then allocated to each envelope. The total amount of cash in each envelope becomes the budget limit.

This method is advantageous since it can help foster prudence in lifestyle and help minimize overspending. There are disadvantages, though, like security concerns and inconvenience.

Another popular way to budget is “zero-based budgeting.” Every peso of the budget will be fully accounted for in terms of specific expenses and savings. This implies that at the end of the month, the total peso amount budget would have been utilized fully and it will thus have a final balance of zero.

This method is favorable since it gives the individual an opportunity to really take ample control of finances. However, this method can be tedious since it will require time and skill for planning and tracking the total budget.

Another popular way to budget is “50-20-30 budgeting.” From the total income, 50 percent will be allocated for needs, 20 percent will be allocated for saving and the remaining 30 percent will be for wants.

Needs and wants have to be clearly differentiated. Needs could be those that are related to basic items like food, shelter and clothing while wants can be other items. In determining whether an expense is a need or want, one has to identify the expense as being either a necessity or a luxury.

The 20-percent allocation for saving will be devoted toward matters like the emergency fund, debt management and retirement planning. This method is appealing because there are just few budget categories to manage.

However, there is the risk of overspending across specific needs and specific wants since tracking of categories might be more general.

There is also a way called “values-based budgeting.” Values would be items that one would consider important in life. In this technique, every major value is assigned a budget. A good sense of self-awareness can help make one identify values that would not only give short-term happiness but also long-term satisfaction.

Hopefully, the individual would be financially literate so that the right set of values can have the corresponding right budget principles. Good character can lead to good values and good budgets.

A budget helps balance the needs of the present and the needs of the future. Everyone should have some form of a budget. There are truly many ways to budget. One can experiment to see the best budget technique or best combination of budget techniques to apply.

Hopefully, the right foundation developed through budgeting can prepare us well for a lifetime of sound financial decisions that lead to success.

****

Gemmy Lontoc is a registered financial planner of RFP Philippines. To learn more about personal financial planning, attend the 74th RFP program this

Gemmy Lontoc is a registered financial planner of RFP Philippines. To learn more about personal financial planning, attend the 74th RFP program this

January 2019.

To inquire, e-mail info@rfp.ph or text <name><e-mail> <RFP> at 0917-9689774.

Source: https://businessmirror.com.ph/ways-to-budget/?fbclid=IwAR0RU3jfgrxWSVvDzh40V5AbSRpAIPh0-VSlfeVTh65JUsoOUWGK00lQKrQ

3,129 total views, 1 views today

Social